Prices are falling at 10% a year as

competition becomes even more intense. There are

40 local manufacturers of minisplits, and most

key components such as compressors are also

locally made.

Thailand manufacturers provide 1.2 million

window units and 2.1 million minisplits, mainly

for export. The products are high quality and

are sold at competitive prices mainly to the OEM

market. However, the main exporters are becoming

concerned about vigorous competition from

Chinese manufacturers in overseas markets, which

are high quality and potentially even lower

priced. To protect Thailand manufacturers at

home, the government has imposed a high import

duty on residential air-conditioning products

imported from outside AFTA.

Thailand manufacturers provide 1.2 million

window units and 2.1 million minisplits, mainly

for export. The products are high quality and

are sold at competitive prices mainly to the OEM

market. |

|

|

However, the main exporters are becoming

concerned about vigorous competition from

Chinese manufacturers in overseas markets, which

are high quality and potentially even lower

priced. To protect Thailand manufacturers at

home, the government has imposed a high import

duty on residential air-conditioning products

imported from outside AFTA.

Thailand manufacturers provide 1.2 million

window units and 2.1 million minisplits, mainly

for export. The products are high quality and

are sold at competitive prices mainly to the OEM

market. However, the main exporters are becoming

concerned about vigorous competition from

Chinese manufacturers in overseas markets, which

are high quality and potentially even lower

priced. To protect Thailand manufacturers at

home, the government has imposed a high import

duty on residential air-conditioning products

imported from outside AFTA.

Close control (for critical applications) is

another market expected to grow at 10% a year,

boosted by significant growth in mobile phones

-- reception on these is often better than for

land lines.

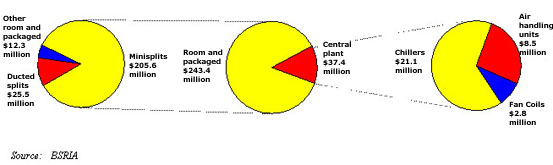

The central plant market is growing strongly

-- particularly centrifugal chillers -- as the

market has been bouncing back after it crashed

down 57% by value after 1996.

Thailand Air-Conditioning Market, 2001

Minisplits

Minisplits account for 95% of all room and

packaged sales by volume and 85% by value.

Because most housing in Thailand consists of

one main room and a shower, the market is

dominated by single splits, with the vast

majority below 5kW.

For larger dwellings the practice is

typically to have more than one smaller unit

rather than one large capacity unit, because

there are no restrictions on the number of

outdoor units placed on buildings, and

multisplits are expensive. Low-cost wall types

dominate, although the flexi-type floor/ceiling

units are often used in bigger homes requiring

larger sized splits.

The Thai room and packaged market fell by 33%

between 1997 and 1999 and the market will only

return to 1997 levels during 2003. As a result,

prices across the sector have continued to fall.

As competition becomes even more intense at home

and abroad, despite the rising market, prices

will continue to fall at around 5% a year in

real terms.

However, rapid growth of the minisplit market

is expected at more than 10% a year. Residential

penetration is only around 40% despite the

extremely hot climate and there is considerable

potential for further increases, particularly

outside Bangkok. Currently 75-80% of

air-conditioning sales are around Bangkok,

Chiang Mai and Phuket. A significant replacement

market has emerged, now accounting for 15% of

sales. Larger sized commercial splits will also

increase strongly with variable refrigerant flow

(VRF) systems growing at an accelerated rate.

Currently only half of all smaller minisplits

are sold for residential applications, the rest

are mainly to retail and office applications,

but a slow increase in the share of residential

applications is now expected.

A key feature of Thailand is that there are

essentially no imports of room and packaged

products while Thailand is one of the world's

largest exporters of RAC windows and minisplits.

In round terms, production is about 1.2 million

window units and 2.1 million minisplits and only

an estimated 400,000 of those units (mostly

minisplits) are intended for the Thai market.

Many of the 'export hungry' Thai

manufacturers supply to OEM including the large

U.S. companies and some European and Middle

Eastern brands. For example, a Thailand

manufacturer supplies O-General, the market

leader of minisplits in Iran.

Levels of production have increased as many

international air conditioning companies have

also set up production facilities to meet the

growing Thai market as well as export to the

Middle East. In all there are eight Japanese and

two American factories.

Costs in Thailand have traditionally been

very low because of low labor costs, but also

because of the intense competition -- at least

40 different local companies manufacturing

residential split units -- many of the local

brands produce only wall splits. In addition,

unit production costs can be kept low in

Thailand because key components, such as

compressors, are manufactured in Thailand,

resulting in lower prices. Despite the low costs

Thai products are considered to be of a good

quality.

However, even the larger Thai manufacturers

are concerned about the competitiveness of the

main Chinese manufacturers. Although they have

yet to make much impact in Thailand, they are

vigorously competing in many export markets.

Thailand manufacturers may soon start to lose

market share abroad to the lower priced, yet

sophisticated Chinese products.

In response to the renewed threat, the Thai

government has already imposed a high import

duty on residential air-conditioning products

coming from outside of AFTA to protect domestic

production, but this is not expected to have

much impact on the threat to the export market.

Thailand room and packaged market,

volume (units), 1996-2005

Central Plant

The central plant market crashed after 1996

from U.S. $77 million to U.S. $33 million, a

drop of 57% in 1997. Strong growth in the market

is now forecast, with centrifugal chillers

growing by 12% a year, but this is merely a

reflection of the market partly 'bouncing back'

with some delayed large projects. Despite this

growth, the market is not expected to recover to

1997 levels until after 2005.

The chiller market is almost entirely

imported. The main reason being that centrifugal

chillers, which form over half of the market by

value, are normally imported from the USA. Other

types of chillers mostly come from the Asian

region. The import tax on chillers is only 5% in

contrast to the 21% levy for other central plant

products.

The air-handling unit market, which is mostly

manufactured locally, has failed to pick up

since 1999 as many of the chillers sold recently

have been for replacement. Industry sources say

that demand is shifting towards the industrial

sector and the product mix is changing.

The fan coil market is mostly the horizontal

concealed type but there are significant sales

of wall and console cased units. Like chillers

the market is growing briskly, but even after

2005 it will be some 30% below its peak of 1996.

For more information, visit

BSRIA

online

Bangkok Companies is a full service

product sourcing company in Thailand.

For your Air Conditioner needs please email

bangkokcompanies@gmail.com with your

requests.

- Home Air Conditioners

- Office & Commercial Air

Conditioning

- Industrial Air Conditioning

- Air Conditioner Components, spare

parts and accessories